The New Rules of K-12 Robotics: Who Buys, What Matters & Why Vendors Fail

The New Rules of K-12 Robotics: Who Buys, What Matters & Why Vendors Fail

Couldn't load pickup availability

Why this report?

The New Rules of K–12 Robotics is a field-tested tactical guide built for vendors and investors who need to win in a fragmented, post-ESSER landscape. It exposes the new rules governing funding, procurement, and adoption—and reveals how top-performing vendors are breaking through while others quietly lose ground.

If you think districts are still buying standalone robotics kits based on novelty or brand name, you’re already behind. This report shows where funding is really flowing, how decisions are made under $5K and above it, and what makes a product survive in the classroom—or sit unused in a closet.

What you’ll learn:

Market realities:

- How the expiration of ESSER created a fractured, unreliable funding environment

- Why $5K is now the critical budget threshold that splits the market into two entirely different procurement journeys

- How Trump-era policy shifts are redrawing public vs. private edtech purchasing behavior

Buyer priorities & procurement behavior:

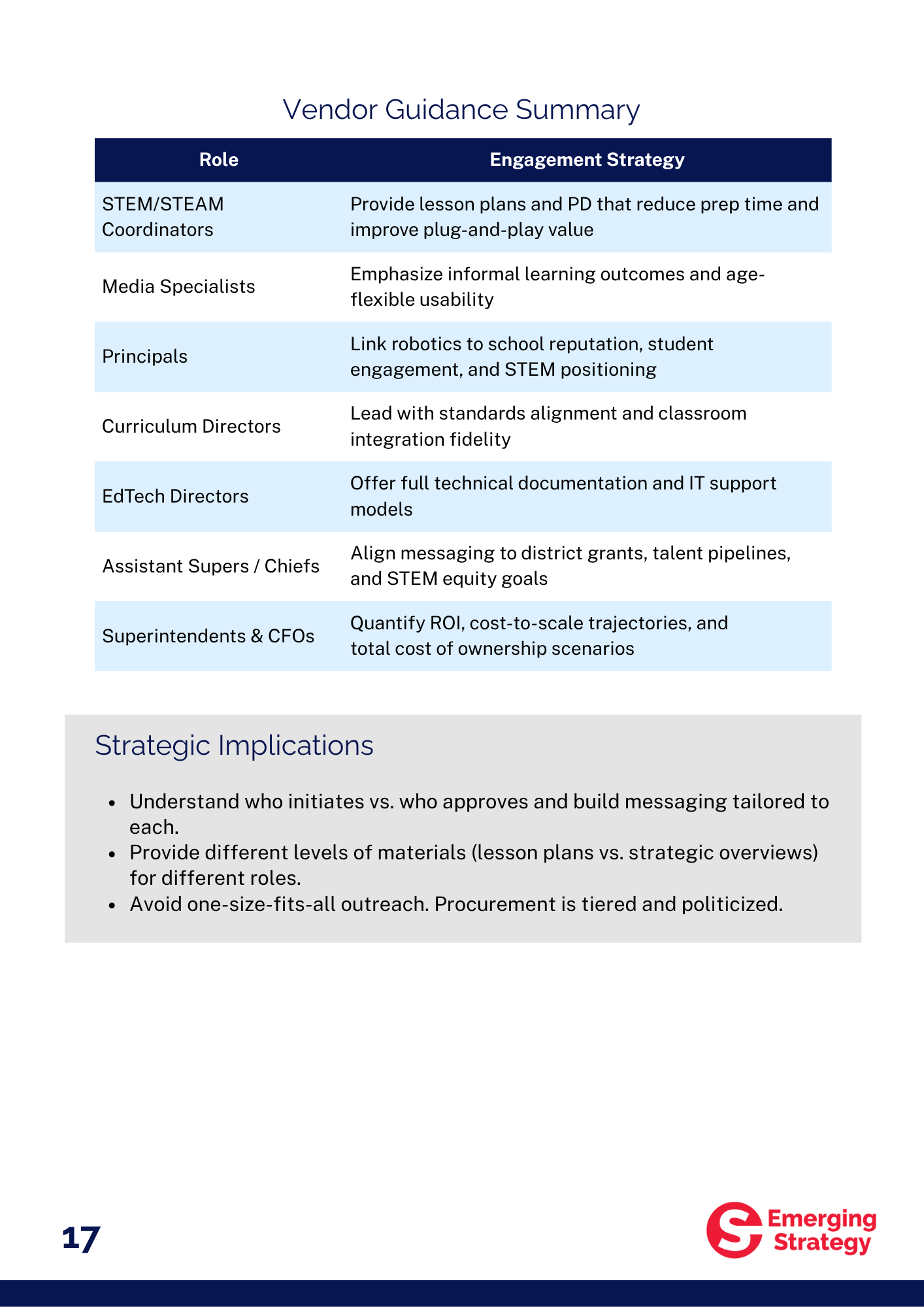

- Which stakeholders matter most—and how to tailor your pitch to each

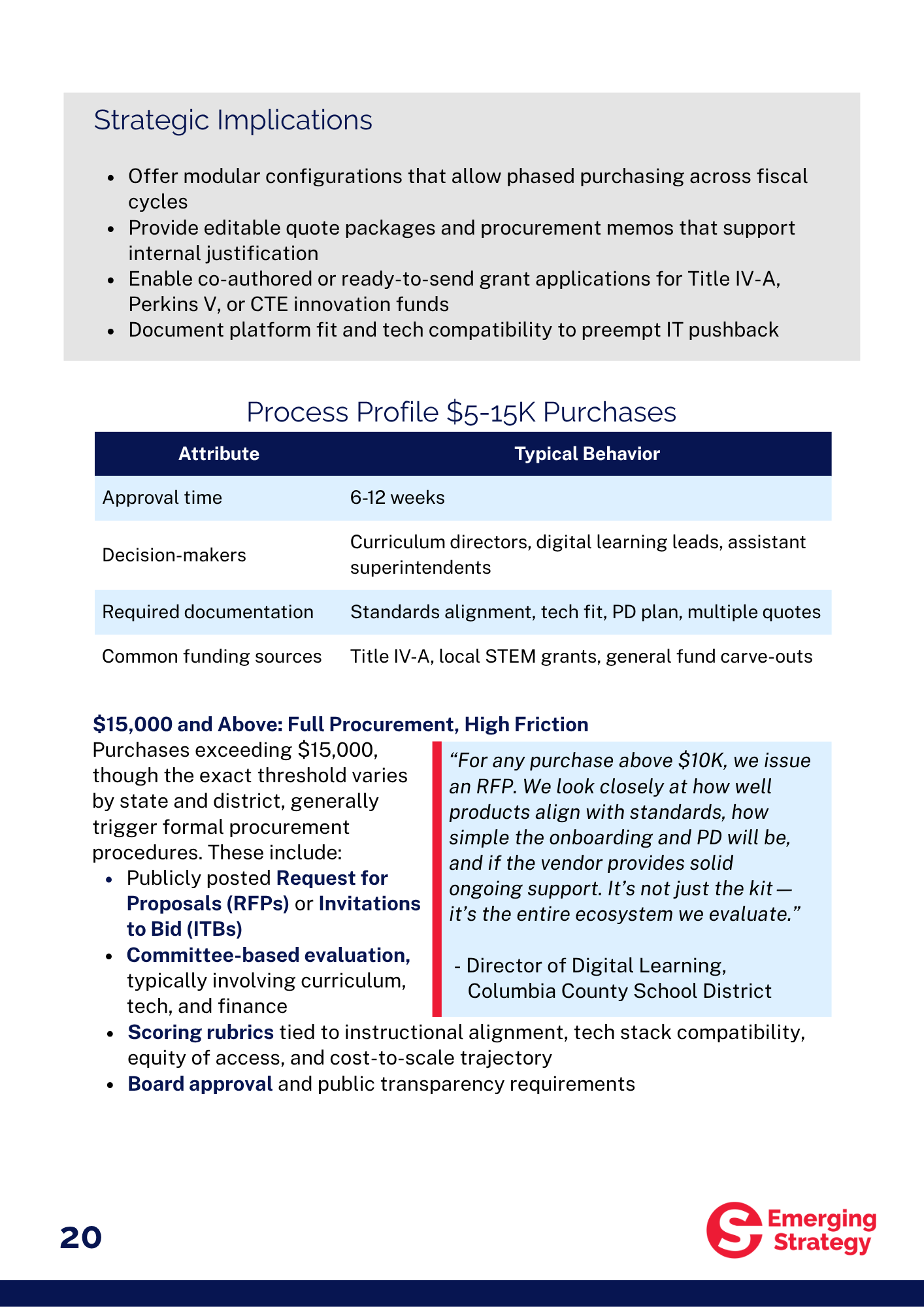

- The hidden dynamics behind RFP timelines, informal pilots, and post-purchase support expectations

- Why even great products fail when they ignore how real procurement works

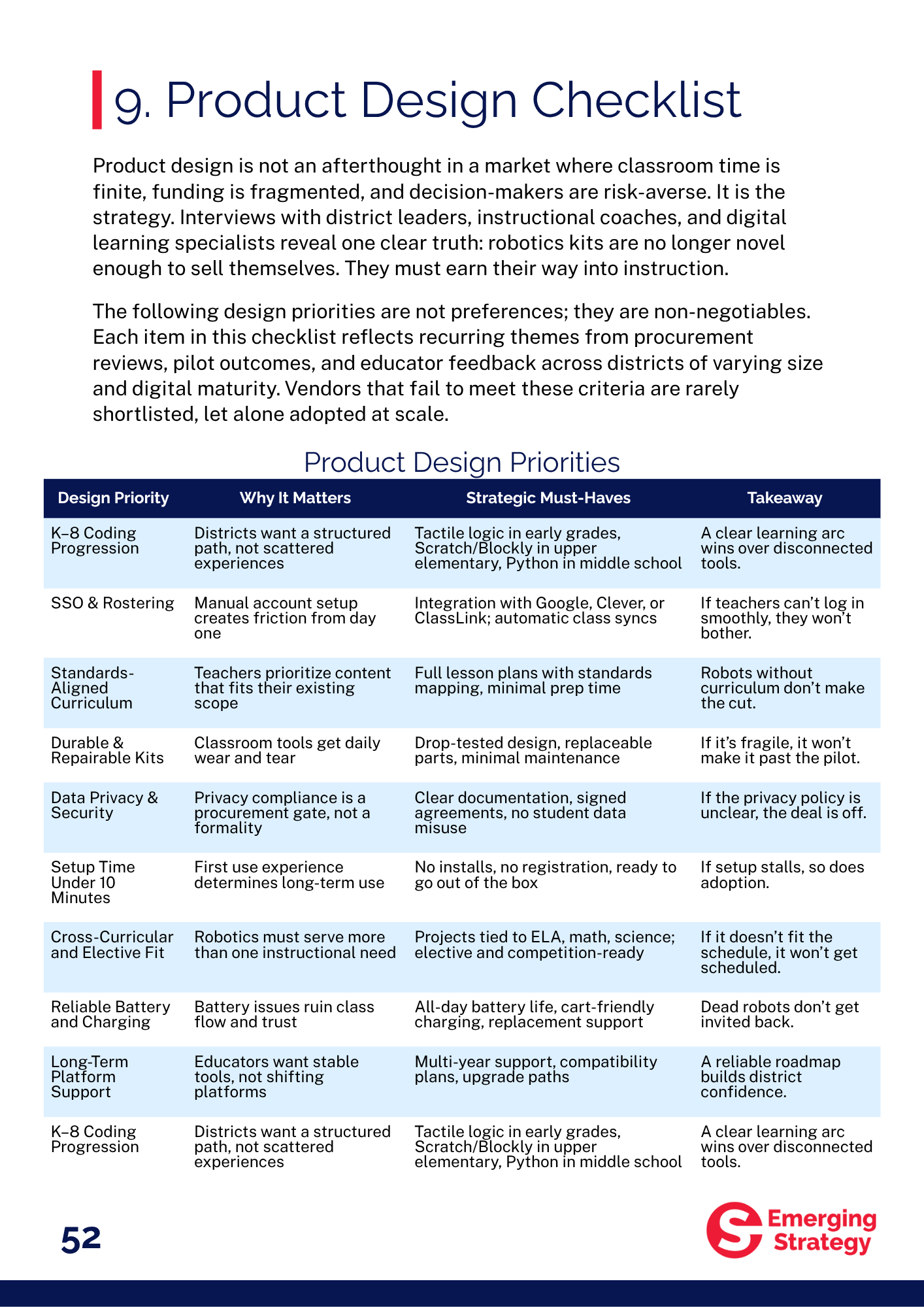

Product expectations:

- What schools actually want: integrated curriculum, plug-and-play ease, and multi-year durability

- The three universal dealbreakers that stall adoption: battery failures, product obsolescence, and broken PD

- Why most “K–5” robotics solutions are failing to gain traction—and how to fix that

Market hotspots:

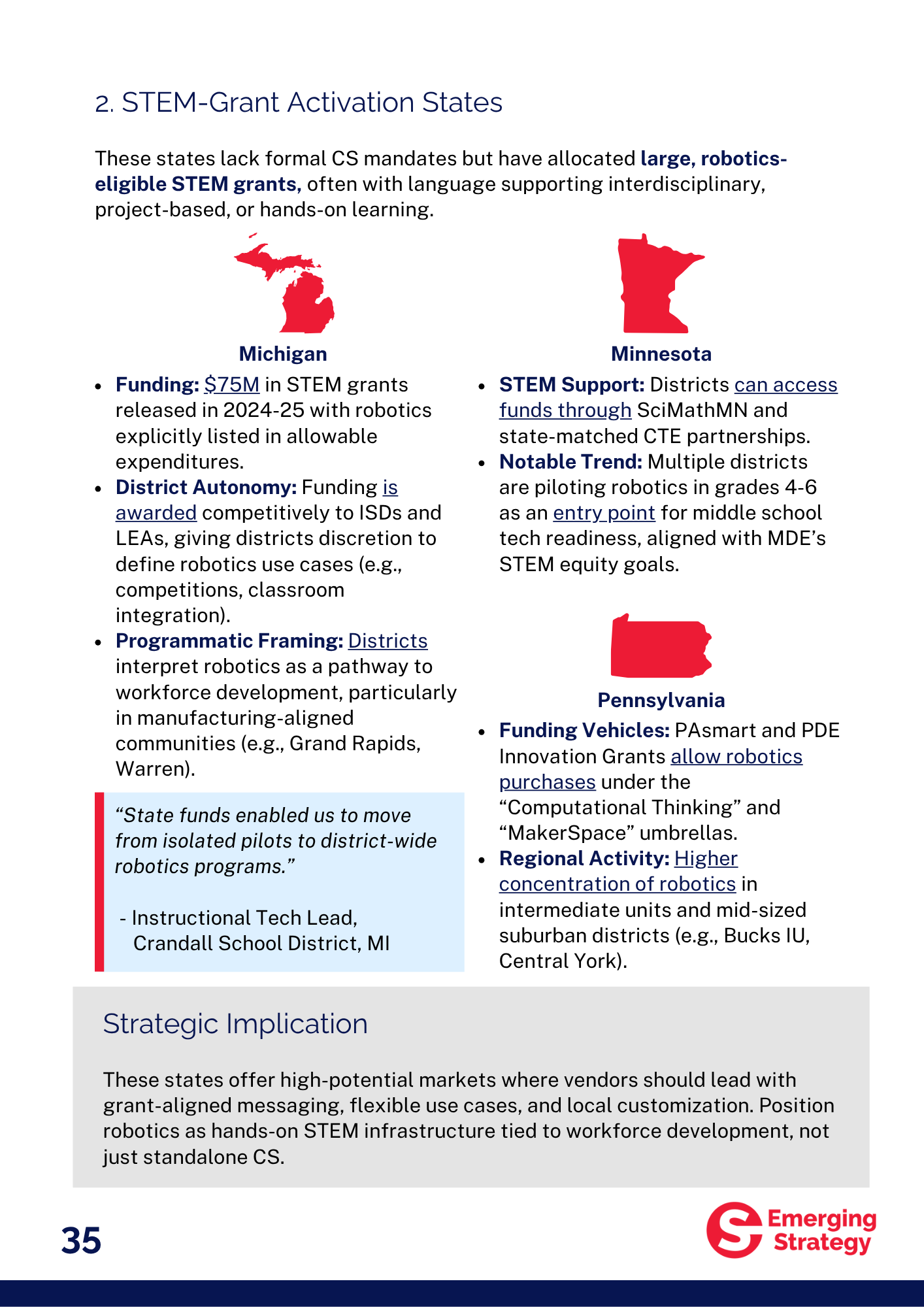

- Which six U.S. states are ripe for rapid robotics expansion (and which ones vendors should deprioritize)

- How local autonomy and funding variability shape vastly different adoption patterns

- Where charters and microschools are accelerating robotics spending—even as public districts stall

Competitive vulnerabilities:

- Where LEGO, VEX, and Sphero are exposed—and how challenger brands are taking share

- Why ecosystem design and vendor support matter more than hardware specs

- What winning vendors in 2025 are doing differently—and how to replicate their moves

Who this is for:

- Robotics and edtech vendors designing GTM, sales, or product strategy in the U.S. K–12 space

- Investors and analysts evaluating growth opportunities in STEM education

- Product and marketing teams looking to build competitive advantage through precision—not just potential

What you get:

- A 59-page PDF packed with tactical, role-specific insights drawn from educators, curriculum directors, and procurement leaders

- Strategic analysis of funding pathways, market segmentation, and state-level demand hotspots

- A detailed teardown of buyer pain points, vendor missteps, and what separates scalable solutions from short-lived pilots

This report is not about trends. It’s about traction.

If your team is still chasing the wrong buyers, pricing above the threshold, or treating robotics like a gadget—not a curriculum platform—you’re losing time and market share. Don’t wait until your competitors figure it out first.

Share